Policy Review

Optimizing Your Life Insurance Portfolio

BECAUSE THERE IS NO TIME LIKE THE PRESENT

Life insurance products are confusing, complex, and often misunderstood. It is an initiative at LIFE Brokerage to educate our advisors so they may provide clarity to their clients.

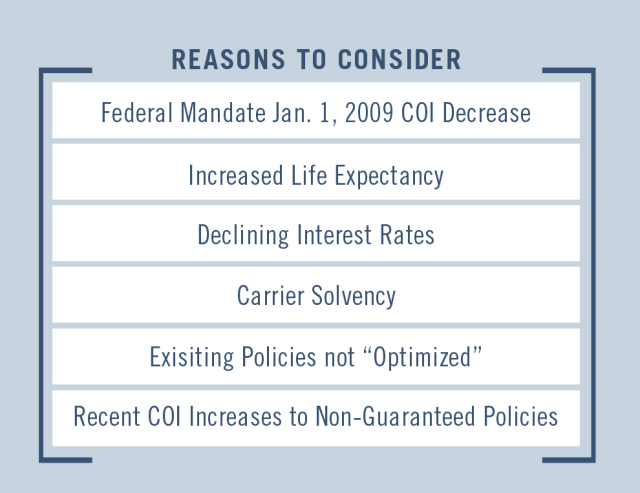

It is often that we uncover that the most efficient policy a consumer can obtain is the one they currently own...it simply needs to be optimized. Our process will involve stress-testing existing policies and researching the current market to determine if existing coverage should be maintained, complimented, or replaced.

It is often that we uncover that the most efficient policy a consumer can obtain is the one they currently own...it simply needs to be optimized. Our process will involve stress-testing existing policies and researching the current market to determine if existing coverage should be maintained, complimented, or replaced.

OUR PROCESS and WHY WE'RE DIFFERENT THAN THE REST

Annual renewable term

Helps improve pricing on term policies with remaining duration of 9 years or less. Promotes cost savings, ability to convert to longer level term period, and carrier diversification.

Select a-term

Helps improve pricing on term policies with remaining duration 15-30 years. Ability to issue level term periods in 1 year increments to coincide with planning needs or existing policy duration. Promotes cost savings and carrier diversification.

Permanent policy review

Analyze policy performance, product features, assess cost of insurance charges, review over loan protection rider, identify chronic/long-term care riders.

Select a-term

Helps improve pricing on term policies with remaining duration 15-30 years. Ability to issue level term periods in 1 year increments to coincide with planning needs or existing policy duration. Promotes cost savings and carrier diversification.

Permanent policy review

Analyze policy performance, product features, assess cost of insurance charges, review over loan protection rider, identify chronic/long-term care riders.

Insurance policy optimization

“Optimize” exiting policies for efficiency in premium/death benefit ratio. Unlock the hidden values invisible to the naked eye.

Decreased dividend/crediting rate rescue

Identify offsetting policies, term blending or interest/dividend dependent contracts in a decreasing interest

rate environment.

Policy loan rescue

Transfer via 1035 exchange, implement an exit/buy-down of existing loan, introduce more favorable loan terms.

Split funded plans

Bifurcate cash value and death benefit for optimal performance by removing unnecessary drag via policy charges to maximize both death benefit and cash

value IRR.

Decreased dividend/crediting rate rescue

Identify offsetting policies, term blending or interest/dividend dependent contracts in a decreasing interest

rate environment.

Policy loan rescue

Transfer via 1035 exchange, implement an exit/buy-down of existing loan, introduce more favorable loan terms.

Split funded plans

Bifurcate cash value and death benefit for optimal performance by removing unnecessary drag via policy charges to maximize both death benefit and cash

value IRR.